The Cashflow Quadrant Robert Kiyosaki Pdf

The Cashflow Quadrant is the follow-up guide to finding the financial fast track that best works for you. It reveals the strategies necessary for moving beyond just job security to greater financial security by generating wealth from four selective financial quadrants. This work will reveal why some people work less, earn more, pay less in taxes, and feel more financially The Cashflow Quadrant is the follow-up guide to finding the financial fast track that best works for you. It reveals the strategies necessary for moving beyond just job security to greater financial security by generating wealth from four selective financial quadrants. This work will reveal why some people work less, earn more, pay less in taxes, and feel more financially secure than others. It's simply a matter of knowing which quadrant to work in.

Financial freedom is a vastly different from financial security.For those of you who have read Rich Dad Poor Dad this book is basically an extension of the lessons taught in that book. Robert Kiyosaki gives a brief description of his journey as an adult going from a short stint living in his car to financial freedom by taking advantage of tax laws and creating assets that create passive income. (My personal gushings about this book can be found here.)The title of the book, The Cashflow Quadrant, Financial freedom is a vastly different from financial security.For those of you who have read Rich Dad Poor Dad this book is basically an extension of the lessons taught in that book. Robert Kiyosaki gives a brief description of his journey as an adult going from a short stint living in his car to financial freedom by taking advantage of tax laws and creating assets that create passive income.

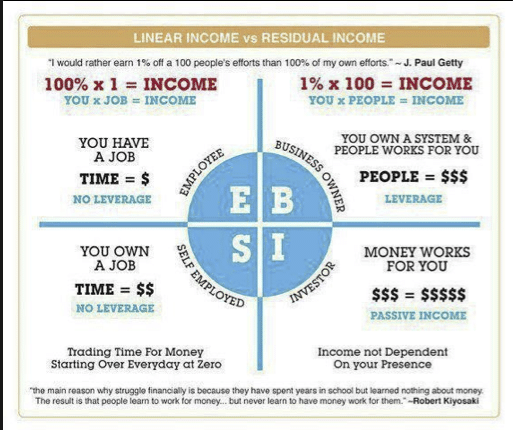

(My personal gushings about this book can be found here.)The title of the book, The Cashflow Quadrant, describes an image that separates people into 4 categories: employee, self employed, business owner and investor. (below)Many distinctions are drawn in regards to the 'left side' and the 'right side' of the quadrant and what it takes to be on each side.Kiyosaki believes strongly in the fact that if you are an E or an S you play an old game that makes sense for governments and business owners because you pay the highest amount of taxes and build large amounts of debt thinking that by doing that you are avoiding taxes through credits or refunds.The left side of the quadrant works the hardest, and is obsessed with going to school to find a job and maintain their 'security.' Those who would be considered an S are people who are self employed and lose their income when they are not at work.

(doctors, lawyers, dentists, etc.) People on the left side of the quadrant can, and some do, make a lot of money and are very successful. The problem with this success is that the more success you encounter the less personal time you have and the harder you have to work.

Again, many people choose this route because they feel secure in the fact that they know where their next paycheck is coming from.People on the 'right side' of the quadrant are not concerned with security and are interested in creating income both as a business owner and investor. Business owners and investors enjoy tax breaks, are seen as visionaries and risk takers and when success comes they are the people who enjoy more free time.This book is a learning tool for those of us interested in moving from the left side to the right side of the quadrant. Kiyosaki is methodical and slow in his approach and encourages people to keep their jobs while they take 'baby steps' towards the B and I quadrants.This is a very simple break down of a book that I would HIGHLY recommend to anybody interested in owning their own company through the creation of a system and investing. Kiyosaki speaks of creating a system that will continuously grow and can run in your absence. If you are not interested and what I just wrote seems like a conspiracy or the rantings of a person jaded by unemployment you wouldn't make it through and this book may anger you.Hope this finds you well.jc. For those of you who want to take control of your financial future, I recommend the Rich Dad, Poor Dad books.

This is the second book in his series. It will not give you specific details of how to make those changes. It changes the way you think about money and opens your eyes to possibilites.

Hopefully, it gives you the courage to make changes in your life to be financially successful. I know that Robert Kiyosaki's books have made drastic changes to our lives and it was only 1 year ago that my For those of you who want to take control of your financial future, I recommend the Rich Dad, Poor Dad books. This is the second book in his series. It will not give you specific details of how to make those changes. It changes the way you think about money and opens your eyes to possibilites. Hopefully, it gives you the courage to make changes in your life to be financially successful.

I know that Robert Kiyosaki's books have made drastic changes to our lives and it was only 1 year ago that my dh read his first book. It's an alright book. Gives you a bit to think about but nothing revolutionizing. The last 40 pages or so are just blatant propaganda for his first book, Rich Dad Poor Dad, and his CASHFLOW games.

If you're going to read one of Kiyosaki's books then you might as well read the original: (and be aware that Kiyosaki's onlysuccessfulventure is the Rich Dad franchise).Conclusion: Skip it. It's an alright book. Gives you a bit to think about but nothing revolutionizing. The last 40 pages or so are just blatant propaganda for his first book, Rich Dad Poor Dad, and his CASHFLOW games.

If you're going to read one of Kiyosaki's books then you might as well read the original: (and be aware that Kiyosaki's only successful venture is the Rich Dad franchise).Conclusion: Skip it. It's a masterpiece of saying nothing but sounding very knowledgeable while you do so. From what I can garner (and it's hard because there are few if any facts to go off in the book) he made his money n the real estate boom in the US. But that seems to have convinced him that he had some magic formula to success no one else had thought of. He has done a really good job at selling snake oil through his books though, so I suppose you have to hand him that. Read this if you believe that all it takes It's a masterpiece of saying nothing but sounding very knowledgeable while you do so.

From what I can garner (and it's hard because there are few if any facts to go off in the book) he made his money n the real estate boom in the US. But that seems to have convinced him that he had some magic formula to success no one else had thought of. He has done a really good job at selling snake oil through his books though, so I suppose you have to hand him that. Read this if you believe that all it takes to make money is some magic beans and a map to the giants house. Why I Read this Book: Anytime a book or author gets as much notoriety as the Cashflow brand has, I feel it is my duty to at least see what the fuss is about. Plus, I can always stand to learn a little bit more about the financial component to success.Review:For those of you who have not yet read the original Rich Dad Poor Dad or at least its review on this site, I recommend you do so before diving into Cashflow.

This book is more of a sequel to Kiyosaki’s first book than anything else, however Why I Read this Book: Anytime a book or author gets as much notoriety as the Cashflow brand has, I feel it is my duty to at least see what the fuss is about. Plus, I can always stand to learn a little bit more about the financial component to success.Review:For those of you who have not yet read the original Rich Dad Poor Dad or at least its review on this site, I recommend you do so before diving into Cashflow. This book is more of a sequel to Kiyosaki’s first book than anything else, however it does serve as a worthy stand-alone book if you so desire.The real beauty of this book as well as any other from the Rich Dad series, is Kiyosaki’s amazing knack for writing in a way that is easy for even the most average of persons to understand. Whether you are a well versed personal finance expert or someone who has done little more than manage an allowance as a child, there is a lot here for both to learn.Much of the book consists of Kiyosaki relating various career paths with his four quadrant system he has developed. This system breaks careers and wealth building into the categories of employee, self- employed, business-owner and investor. The real key to the whole system is getting yourself into either the business-owner or investor quadrants in order to really get on the path to financial success and freedom. It is these two quadrants together that lead to great wealth building.Some of the teachings will no doubt seem obvious and kudos to you if that is the case more often than not.

The unfortunate truth is that a great majority of our society has been brought up thinking that the career path of being a great employee of a great company is what all our training as children all the way through university has been building towards. Please don’t get me wrong, for many the path to success is directly up the corporate latter. This is fine with me as long as those who have defined success in this way have done so while knowing all of the other options available.If Robert Kiyosaki has done nothing more than bring attention to the fact that there is much more possibility to a career than getting a job for someone else, he has done us all a great service. In fact there is much more available now than there ever was, and the opportunities will only grow. Those of you who have spent a few hours on Reading For Your Success have no doubt been unable to avoid the many experts proving this to be the case. The books you will find here show you the many paths to financial and personal success.

It seems like every day someone is finding another unique and exciting way to define their success, so please continue to explore.Reading Cash Flow Quadrant was extremely liberating for two reasons. First off it made me even more aware of the new and exciting roads to success that were not encouraged throughout my years in university and prior. For me I can never read enough about the road less traveled. The second was that I knew there were millions of people reading Robert Kiyosaki’s books all over the world and there was a pretty good chance that like-minded excitement and inspiration was brewing in these fellow readers as well.Keep in mind that it is not just you or me as individuals who are better off for reading books like Cash Flow and others on this site. It is our success-minded population as a whole that is better off for those around us being as motivated and encouraged as we are. Mark my words; it will be people just like yourself who will be with you all along your journey to success.

I encourage you to embrace the lessons in this book for their value, but more importantly I encourage you to embrace the experiences and opportunities that a book like this represents on your road to success. The odds are that you will never be able to look back and pinpoint just one thing that led you to accomplish your goals, but instead it is the accumulation of all your knowledge and experience that grants you success. Cashflow is another worthy lesson to add to the list.-Reading for Your Success. This book expands on the concepts presented in. Don't expect a detailed guide to getting rich; Kiyosaki explains that he doesn't write how-to books, but rather provides the mental framework that's necessary for gaining great wealth. He calls it the BE-DO-HAVE approach: 'strengthen your thoughts (being) so that you can take the action (doing) that will enable you to become financially free (having).' Kiyosaki promotes himself as living proof that you can get rich quickly; he went This book expands on the concepts presented in.

Don't expect a detailed guide to getting rich; Kiyosaki explains that he doesn't write how-to books, but rather provides the mental framework that's necessary for gaining great wealth. He calls it the BE-DO-HAVE approach: 'strengthen your thoughts (being) so that you can take the action (doing) that will enable you to become financially free (having).'

Kiyosaki promotes himself as living proof that you can get rich quickly; he went from homeless to millionaire in 4 years, and financially independent in another 5. Understandably, he doesn't believe in the 'get rich slowly' movement, and thinks you're wasting your time if you do.

He also rejects such other common wisdom as seeking job security, relying on mutual funds, and considering a house an asset.His promise: 'If you have a secure system that produces more and more money with less and less work, then you really do not need a job, or need to worry about losing your job or need to live life below your means. Instead of living below your means, expand your means. To make more money, simply expand the system and hire more people'.The last page of the book provides a great summary: 'Your boss's job is to give you a job.

It's your job to make yourself rich. Are you ready to stop hauling water buckets and begin building pipelines of cash flow to support you, your family, and your lifestyle? Minding your own business might be difficult and sometimes confusing, especially at first.the hardest part of the process is at the start. Once you make the commitment, life really does get easier and easier.' The reference to hauling water buckets relates to an analogy at the beginning of the book. Think of money as water. Most people try to increase their income by working more hours, or carrying more buckets of water.

This is exhausting, and can only get you so far. This is an intriguing follow-up to 'Rich Dad, Poor Dad,' and I enjoyed the way Kiyosaki devised his four quadrants. He definitely has a point about the difference between each quadrant or type of person. He provides sensible advice for transiting between columns.As an interesting aside, he makes an excellent point about the public education system.

I had already begun homeschooling my children because of many of the points that he discusses in his book. Specifically, the system's tendency to This is an intriguing follow-up to 'Rich Dad, Poor Dad,' and I enjoyed the way Kiyosaki devised his four quadrants. He definitely has a point about the difference between each quadrant or type of person. He provides sensible advice for transiting between columns.As an interesting aside, he makes an excellent point about the public education system.

I had already begun homeschooling my children because of many of the points that he discusses in his book. Specifically, the system's tendency to create employees who do things exactly and unquestionly, without thinking outside the box. I, personally, am not homeschooling my children so that they can grow up and become 'B' or 'I' folks (though I'd like to see them do so), but so they learn how to think and question. It was just interesting to see those points brought up against the public education system in a financial book.My intended method of managing money trends more towards Dave Ramsey's advice than Kiyosaki's, in terms of acquiring (or not acquiring) debt, but given the local housing bust, I think Ramsey's advice has certainly played through. That said, I appreciated Kiyosaki's perspective on 'how can I afford this' rather than 'I can't afford this'; that is, seeking creative methods to finding a solution, rather than giving up.An interesting, thought-provoking, financially helpful book. The only problem I have is that I always find myself seriously considering purchasing Kiyosaki's $200 board game when I finish. (Not because he turns the entire book into a commercial - although he does mention it frequently - but because I am interested in seeing how it works and how much it really helps to change financial attitudes.).

The much maligned Robert Kiyosaki is here to open your eyes to the new age of finance. The age in which great sums of money are needed just to survive into retirement. Do you realize that if you're in your 20's now you'll need approximately $2.5 million to retire on? Just look at how quickly those gas prices are going up and imagine the cost of living 45 years from now.Kiyosaki believes that the government and business are conspiring to keep the general public down by advocating education as The much maligned Robert Kiyosaki is here to open your eyes to the new age of finance. The age in which great sums of money are needed just to survive into retirement.

Rich Dad's Cashflow Quadrant Pdf

Do you realize that if you're in your 20's now you'll need approximately $2.5 million to retire on? Just look at how quickly those gas prices are going up and imagine the cost of living 45 years from now.Kiyosaki believes that the government and business are conspiring to keep the general public down by advocating education as the end-all and cure-all to the American Dream. As a former educator at the college / university level, I can tell you that an education will get you a direct ticket to debt if you don't look to your financial betterment and learn how to invest in business and real estate. This book is a must read for people who don't want to struggle financially all their lives or end up working as a Wal-Mart greeter at 75.And if you think, like many of my former students, that a $100,000 salary will bring you wealth and security into retirement, think again. Considering that half that money will go in taxes (income, property, sales, etc.) you've got a miserable $50,000 left over.

That should cover your mortgage, now what?Kiyosaki and others on the cutting edge, realize that today one cannot rely on the government or one's employer for their financial present or future and that owning a business in some capacity is the wave of the future. And more and more people are jumping on the bandwagon, home based business on the rise (interesting that the majority of new entrepreneurs are women).This is a must read for current and future providers.A MUST READ!!! After reading Robert's acclaimed novel, Rich Dad Poor Dad, I knew I had to jump to get this book! While its predecessor mainly explains what differentiates the poor and middle class from the wealthy, Cashflow Quadrant outlines how the wealthy ascend to financial freedom, and the levels that are required to equip oneself with financial literacy. There are four main types of people: E for Employees, S for Self-Employed, B for Businessman, and I for Investors. Kiyosaki reiterates time and time After reading Robert's acclaimed novel, Rich Dad Poor Dad, I knew I had to jump to get this book! While its predecessor mainly explains what differentiates the poor and middle class from the wealthy, Cashflow Quadrant outlines how the wealthy ascend to financial freedom, and the levels that are required to equip oneself with financial literacy.

There are four main types of people: E for Employees, S for Self-Employed, B for Businessman, and I for Investors. Kiyosaki reiterates time and time again how important it is that the poor and middle class-who usually operate as Es and S's-gain the financial education and mindset they need to be Bs and Is like the rich. In what were the best 300 ebook pages of my 17 year old life (Yup, I'm a millenial babe!), Kiyosaki lists out the ways the rich operate financially, how they accrue assets unlike liabilities, and how the design of our fiat monetary system is designed so that Bs and Is are more affluent and advantaged than Es and Ss.I came into this book with a somewhat matured mindset about money, having just read Rich Dad Poor Dad. But some main points/tips of advice that caught my eye in Kiyosaki's book were the following:'In the game of money, strive to be the bank, not the banker'If you taking the risk (when buying property or making any investment for that matter), make sure you're getting paid for it.

In other words, make sure you are not paying to take a loss.' 'Unless you're getting passive income from your house, it is a liability and not an asset'Money=debt. Remember that. Try to have as few debts as possible. If it's a personal debt, make sure it's small. If it's large debt, make sure someone else is paying for it.' 'The rich protect their money by creating corporate bodies for them while Es and Ss act as human ones.'

'Es and Ss strive for safety and job security. Bs and Is strive for financial freedom'Kennedy was the last president to challenge the Federal Reserve System' (more of a fun fact than a financial OMG moment)'Pay yourself first. Always'Investing involves risk (something that's inevitable and can only be controlled not extinguished). Being financially uneducated is risky.' 'We are in the Information Age, where the Industrial-Age mindset that the government should give us entitlements like Social Security and Medicare are long outdated. In the Industrial Age, the cookie cutter formula of 'go to school, get good grades, and get a secure, high-paying job' is an obsolete way of thinking, and yet we continue to base our economy off of that.' I also made sure to jot down the list of books that Kiyosaki recommended in Cashflow Quadrant (but since this is Feb.

2017, and a certain Cheeto in Chief is in office, I won't be reading Art of the Deal anytime soon). I recommend reading any of these books to expound your insight in economic history, theory, and application, like Kiyosaki said:The Worldly PhilosophersThe Creature of Jekyll IslandUnlimited WealthThe Sovereign IndividualThe Crest of The WaveThe Great Depression AheadThe Wealth of NationsI hated myself for it, but I found myself nodding in awe at the points he was making about our failed government-backed social welfare system. Although I'm a big proponent of some of the welfare he renounced, I know that what lies for me in terms of Social Security will most likely, if not definitely be long gone by the time I'm retired.

And throughout this book, I was all too familiar with the highlighter icon on my OneNote because all this man spoke was truth! I may come from an ignorant place, since my only financial experience has been with my allowance, I think in principle, this book gets it. I was so thrilled the author actually recommended more books for me to quench my appetite for more finance books. I'm currently on The Creature of Jekyll Island, and hope to put his advice to good practice during college with my $100k in debt as my net worth! An extension of the Rich Dad Poor Dad series. The author had introduced the Cashflow quadrant in his first book and has attempt a detailed version about it but seems to have failed in doing that.The cashflow quadrant identifies the different means of making a living - Employee (E), Self-Employed (S), Business Owner (B) and Investor (I). The idea is to move from active income i.e.

E or S to B or I. An Investor makes minimal effort to earn money and let's his capital does the job. This should be An extension of the Rich Dad Poor Dad series. The author had introduced the Cashflow quadrant in his first book and has attempt a detailed version about it but seems to have failed in doing that.The cashflow quadrant identifies the different means of making a living - Employee (E), Self-Employed (S), Business Owner (B) and Investor (I). The idea is to move from active income i.e. E or S to B or I. An Investor makes minimal effort to earn money and let's his capital does the job.

This should be the eventual objective of every person according to the author.While the concept itself is useful but doesn't warrant a book of itself. A lot of the content is repeated from the first book.

The Cashflow Quadrant By Robert Kiyosaki Pdf

The author has tried to put in a lot more examples in this book which adds value but didn't feel the need for as many.The concept isn't hard to understand and the author would have done to combine it with other concepts. “You can never have true freedom without financial freedom.”“But I knew there was more to life than just going to school to gain another professional credential.”“Rich dad taught me that “you can’t do that” doesn’t necessarily mean you can’t. It more often means they can’t.”“Most people go to school and learn to be players in the game, but no one explains the rules to them.”I fell in love with this book already from the first pages.

It was so hard for me to stop reading it and do something else. “You can never have true freedom without financial freedom.”“But I knew there was more to life than just going to school to gain another professional credential.”“Rich dad taught me that “you can’t do that” doesn’t necessarily mean you can’t. It more often means they can’t.”“Most people go to school and learn to be players in the game, but no one explains the rules to them.”I fell in love with this book already from the first pages. It was so hard for me to stop reading it and do something else.

There are rarely books who make me fall in love with them so hard. But it was like the author spoke about the things I knew so well. It strengthened my belief that I’m on the right path and my convictions aren’t so crazy.What I really like about it was the fact that it made me look different at a business. For example, it’s not that wise to put an emphasis on the product itself, but rather on the business system. It was fascinating to discover new ideas, this one being one of them.Definitely recommend this to anyone, no matter if they are into entrepreneurship or not. It will change your perspective about a lot of things.

One of my favourite books now.One downside is that it has a lot of information that the author keeps repeating. The book offers a neat summary of the original Rich Dad, Poor Dad philosophy and might be the push you need to move from the left side of the quadrant (employee or self employed) to the right side (business owner and/or investor). Rather than offering practical steps, it puts forth the idea that the difference between these sides is the level of security you are willing to sacrifice and endeavors to push your threshold for risk-taking so you can achieve financial freedom.While I agree with the The book offers a neat summary of the original Rich Dad, Poor Dad philosophy and might be the push you need to move from the left side of the quadrant (employee or self employed) to the right side (business owner and/or investor). Rather than offering practical steps, it puts forth the idea that the difference between these sides is the level of security you are willing to sacrifice and endeavors to push your threshold for risk-taking so you can achieve financial freedom.While I agree with the philosophy, I do wonder how many actually have the savvy to succeed as business owners and escape the situation of living in one's car that Kiyosaki experienced - could they risk greater financial and personal distress in the pursuit of super wealth over basic wealth? I suppose it's up to each one of us to determine that for ourselves and make the choice of whether or not to try. It is a complicated task to review a non-fiction.

So here are the parameters upon which I see the book.Avoiding Redundancy: 1/5 (It keeps on rambling about the same idea on every page)Case Studies: 2/5 (There's only what action was taken and what happened, no middle input is given)Authenticity: 2/5Readability: 3/5Overall: The book deals with the idea of moving from 'Employee' to 'Entrepreneur'. It is fine for the first few pages but then the ideas start to get redundant. A sane person can deduce It is a complicated task to review a non-fiction. So here are the parameters upon which I see the book.Avoiding Redundancy: 1/5 (It keeps on rambling about the same idea on every page)Case Studies: 2/5 (There's only what action was taken and what happened, no middle input is given)Authenticity: 2/5Readability: 3/5Overall: The book deals with the idea of moving from 'Employee' to 'Entrepreneur'. It is fine for the first few pages but then the ideas start to get redundant. A sane person can deduce the ideas that the author wants to deliver.

Rather than being a 300-page novel it can be shortened to 100 pages.